Micro Entity Status: Qualifying to Reduce Patent Fees

Are you a small business or an individual inventor filing for a patent in the U.S.?

If so, keep reading to learn about how you can reduce your patent fees through micro entity status. Applicants that qualify for small or micro entity status are eligible for substantial discounts on USPTO fees associated with filing and maintaining a patent under a micro entity status.

This article highlights the qualifications of micro entity status and how to know if you or your business qualifies for the reduction in patent feeds.

Entity Statuses

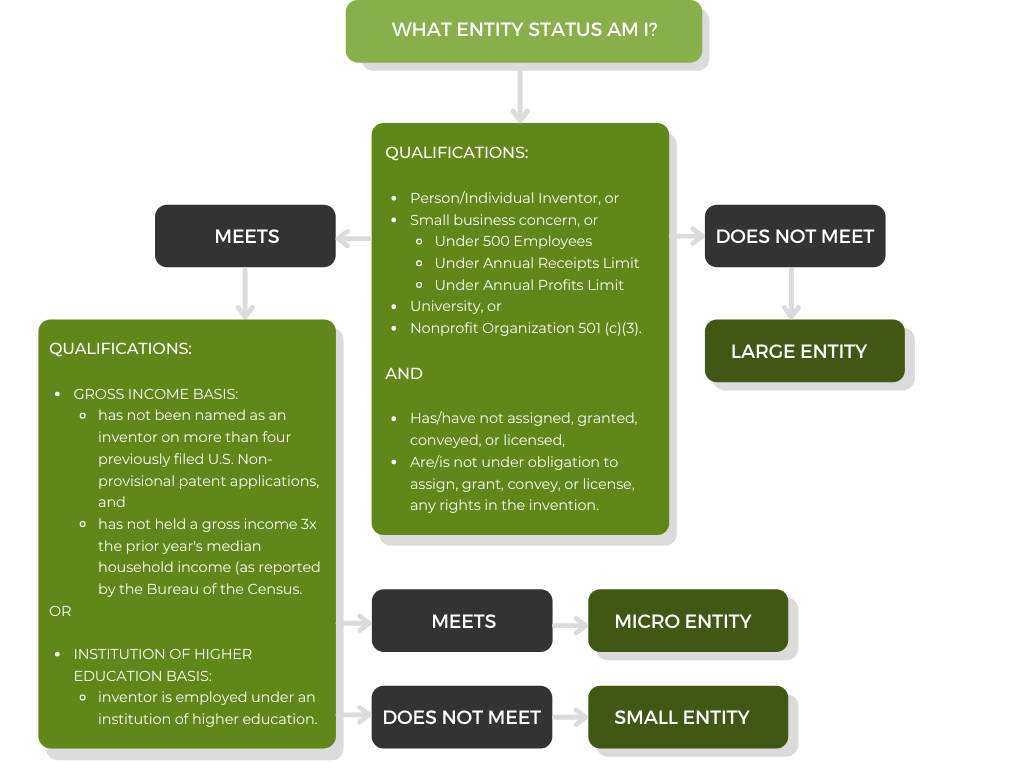

Patent applicants fall under a variety of statuses that are determined by their relationship to other entities, the number of patents they own, and the type of patents they own. These entity statuses are generally classified as large entity, small entity, and micro entity.

Micro entity status is a newer status, introduced under the America Invents Act Leahy-Smith America Invents Act (“AIA”) in 2011 as an effort to reduce the cost of patenting for small businesses and individual inventors.

Why do these statuses matter?

The fee schedule for patent applications and maintenance is based on the size of the entity filing the application. Each entity status directly affects the UPSTO fees for filing, searching, examining, issuing, appealing, and maintaining patents. As a general rule, large entities pay higher USPTO fees than small entities and small entities pay more than micro entities.

Entity Status Qualifications

To determine which entity status you or your business qualify under, you must first understand the requirements for each status. The USPTO has published extensive guidance on their website to help determine which entity status you or your business falls into. Below are summaries of those qualifications.

Small Entity

Applicants that fall under small entity status are generally applicable for a 50% discount on USPTO patent fees.

Small Entity status is defined by the 37 CFR 1.27 and patent law as a:

- Person/Individual Inventor,

- Small business concern,

- University or wholly owned subsidiary of such, or

- Nonprofit organization of 501(c)(3) status or wholly owned subsidiary of such.

A small business concern is defined by the Small Business Administration (“SBA”) as:

- Organized for profit,

- Has a place of business in the U.S,

- Operates primarily within the U.S. or makes a significant contribution to the U.S. economy through payment of taxes or use of American products, materials or labor,

- Is independently owned and operated,

- Is not dominant in its field on a national basis.

And meets the size standards of:

- Employees (less than 500 employees),

- Annual receipts (dependant on industry),

- Annual profits (dependant on industry).

In addition, to obtain small entity status, you or your organization:

- Has/have not assigned, granted, conveyed, or licensed,

- Are/is not under obligation to assign, grant, convey, or license, any rights in the invention.

If you have transferred some rights in the invention or are under an obligation to transfer some rights in the invention, you may still qualify for small entity status so long as the party or parties involved in the transfer are also qualified for small entity status.

Micro Entity

If you or your organization have qualified for small entity status, you may also further qualify under micro entity status.

Applicants that further fall under micro entity status are generally applicable for a 75% discount on USPTO patent fees.

There are two ways that an applicant can qualify for micro entity status through the U.S. patent system.

- Gross Income Basis, or

- Institution of Higher Education Basis.

Gross Income Basis- To qualify under the gross income basis, each inventor on the application must qualify as follows:

- has not been named as an inventor on more than four previously filed U.S. Non-provisional patent applications,

- has not held a gross income 3x the prior year’s median household income (as reported by the Bureau of the Census.

Median Household Income:

Consider that the median US household income in 2020 was assessed at $67,521. Qualifying for Micro entity status with a Maximum Qualifying Gross Income limit (“MQGl”) is gauged by whether each inventor makes 3x the prior year’s median household income. Therefore, the MQGl for 2021 through the time of publishing of this article (published March 23, 2022) is approximately $202,563.

In comparison, almost ten years ago the MQGl was set at $150,162 (limit effective March 19,2013 through September 16, 2013) and this prior year the MQGl sat at $206,109 (limit effective September 15, 2020 through September 13, 2021).

To verify the current micro entity discount rate, you can visit the USPTO’s Micro Entity Status webpage.

Institution of Higher Education Basis- To qualify under this basis, each inventor must be employed under an institution of higher education.

Large Entity

If an applicant does not fall under small entity status, they will be considered a large entity. Large entities do not receive a discount of USPTO patent fees.

Current Entity Fees for Patent Applications

To view current patent fees for Small, Micro, and Large entities, consult with a licensed patent attorney or visit the USPTO’s Fee Schedule page here.

Reduce your patent fees

Patent prosecution can be a substantial investment to some. Any opportunity to reduce the fees is significant and realistically, qualifying for small entity status is not difficult. If you think you may qualify as a small or micro entity, be sure to indicate this to your qualified patent attorney or the patent law firm representing you.

ONGOING Obligations: Updating Entity Status

Each applicant is obligated to update the patent office anytime their entity status changes. When an entity status is updated, the fees will change to reflect the new entity status, however no retroactive fee balance is assessed on the applicant.

In instances where the wrong entity status was provided in error, the applicant is obligated to repay the difference in fees owed.

Start with a Free Consultation

To better understand the patent process or take the next steps in securing your innovation, please contact us for a free consultation with a registered patent attorney.

At Founders Legal, we offer a variety of cost-efficient patent services for clients of all sizes. From patent searches and patent drafting, to filing and prosecuting international patent application, we can help you every step of the way. Click here to learn more.