Joint Study Highlights the Role of Patents and Trademarks in Securing Startup Funding and Facilitating Successful Exits

A recent study by the European Patent Office (EPO) and the European Union Intellectual Property Office (EUIPO) unveiled a crucial truth: Intellectual Property Rights (IPRs) are not merely legal tools, but significant catalysts in a startup’s journey towards financial success. The research reveals the critical role of patents and trademarks in enhancing a startup’s ability to secure venture capital and navigate towards successful exit strategies.

Table of Contents

- Key Findings

- From Protection to Funding: The Strategic Value of Early IP Filings

- Leveraging IP for Enhanced Exit Outcomes

- Scaling Up: The Expansion of IP Rights in Growing Startups

- The Strategic Edge: Why Investors Favor IP-Endowed Startups

- Final Thoughts & Sources

From Protection to Funding: The Strategic Value of Early IP Filings

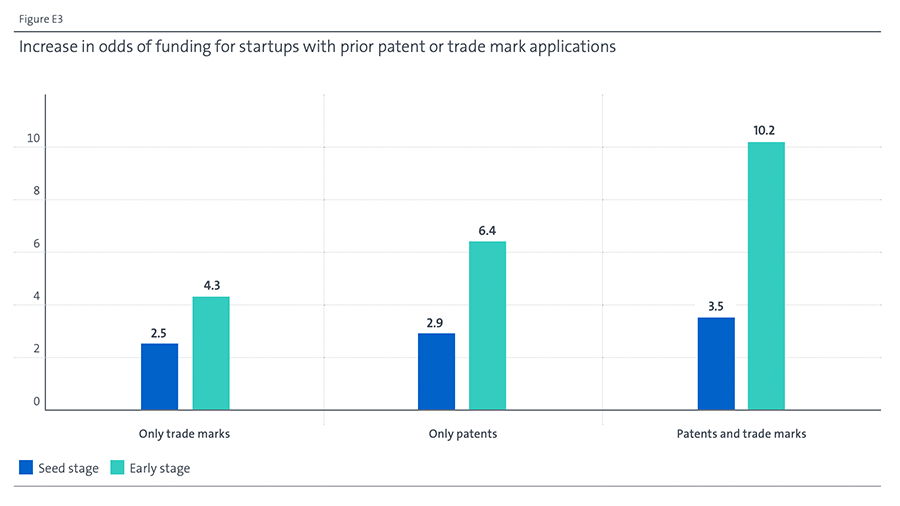

A standout finding from this study is the significant advantage held by startups that possess both trademarks and patents during their initial seed or early growth stages. The findings reveal a striking advantage for startups that proactively secure both trademarks and patents in their nascent stages:

- Remarkable Funding Advantage: Startups with both trademarks and patents are up to 10.2 times more likely to secure funding successfully in comparison to those without these IP rights.

- Significant Boost from Individual IP Rights: The advantage is also notable for startups with either type of IP right – those with only trademarks are 4.3 times, and those with only patents are 6.4 times, more likely to receive funding.

This data highlights a crucial trend: investors are increasingly favoring startups that not only innovate but also take strategic steps to protect their innovations and brand identity from the outset.

Leveraging IP for Enhanced Exit Outcomes

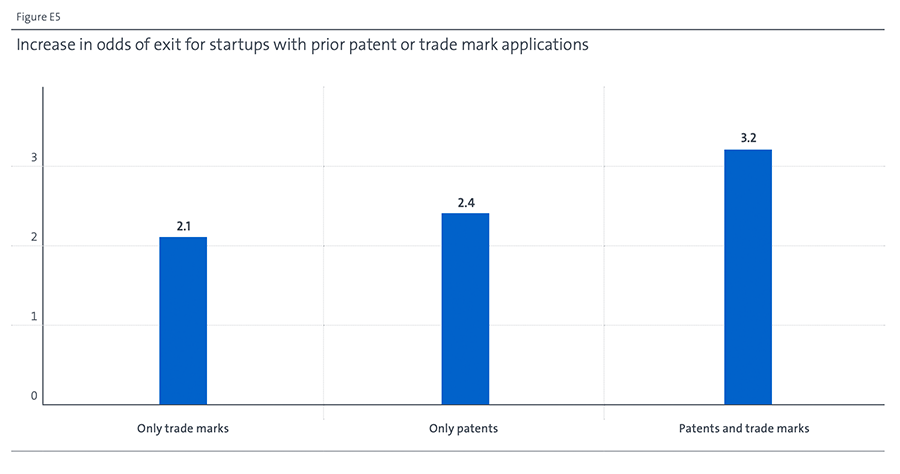

Intellectual property rights are not just protective measures; they are pivotal in shaping the exit trajectories of startups. The study delved into this aspect and uncovered compelling findings:

- Increased Likelihood of Successful Exits: Startups with either patents or trademarks are more than twice as likely to achieve a successful exit via IPO or acquisition.

- Significant Advantage with Dual IP Rights: For startups that hold both patents and trademarks, the probability of a successful exit more than triples.

This trend can be attributed to the fact that IP rights, such as patents and trademarks, often signal innovation, market uniqueness, and a readiness for large-scale commercialization, making these startups more attractive to potential acquirers or public market investors.

Scaling Up: The Expansion of IP Rights in Growing Startups

As startups progress through their growth phases, a significant increase in their engagement with intellectual property (IP) rights is observed:

- Initial Seed Stage: About 10% of startups file for a patent.

- Later Funding Stages: Patent filings increase to 44%; trademark filings grow from 28% to 72%.

This escalation in IP filings suggests a correlation between seeking external funding and the need for robust IP protection, reflecting:

- Investor Expectations: Startups recognize the necessity of securing their innovations and brand identity to attract substantial funding.

- Risk Management and Value Creation: By securing patents and trademarks, startups protect against infringement and build a valuable portfolio for future business deals, including partnerships, mergers, or acquisitions.

The progression in IP filings also mirrors the maturation of a startup’s business strategy:

- From Product Development to Market Positioning: The focus shifts from initial development to solidifying market presence and protecting innovations and brand identity.

The Strategic Edge: Why Investors Favor IP-Endowed Startups

Investors show a heightened interest in startups that actively engage in securing IP rights with patents and trademarks. This preference is rooted in several key factors that align with the goals of both the investors and the startups:

Patent Filings as Indicators of Technical Capabilities:

Patents serve as a tangible measure of a startup’s technical prowess and innovation. They provide a clear indication of the firm’s ability to develop new technologies or improve existing ones. This is not just a reflection of the startup’s current capabilities but also a testament to the skills and ingenuity of its team. Investors recognize that a strong technical foundation is often predictive of a startup’s potential for growth and success in the market.

Securing Higher Returns through Reduced Competition:

Patents play a crucial role in safeguarding a startup’s unique products or services from being replicated by competitors. By holding exclusive rights to their innovations, startups can establish a more dominant position in the market. This exclusivity typically translates into higher returns for investors, as the reduced competitive pressure allows for greater market share and potentially higher profit margins.

Longevity and Security in the Face of Adversity:

Both patents and trademarks offer enduring value, surviving beyond the life of the company in cases of bankruptcy or financial distress. This enduring nature provides a layer of security to investors and lenders, as these IP assets can be sold or licensed, offering a potential return on investment even if the startup itself does not succeed. The ability to retain value independently of the company’s operational success makes IP rights particularly attractive to investors, who are always mindful of mitigating risks.

Final Thoughts & Sources

The EPO and EUIPO study provides compelling evidence of the critical role that intellectual property rights play in the financial trajectory of startups. By securing patents and trademarks, startups not only protect their innovations but also significantly enhance their prospects for funding and successful exits.

For investors, a startup’s engagement in securing IP rights is often seen as a hallmark of innovation, market potential, and a prudent approach to risk management. These factors collectively make such startups more attractive investment opportunities. The results of the study underscores the necessity for startups to consider a robust IP strategy as part of their business development plan.

For startups seeking to navigate the complex landscape of intellectual property and funding, professional guidance can be invaluable. At Founders Legal, we offer experienced and knowledgeable support to help startups leverage their IP assets for growth and success. Contact us to learn more about how we can assist your startup in maximizing its potential through strategic use of intellectual property rights.

Sources & More Information:

- Press Release: Startups with patents and trade marks are 10 times more successful in securing funding, new study finds

- Full Study: Patents, trade marks and startup finance Funding and exit performance of European startups

Intellectual property legal team

Patent Agent

Firm Administrator

Administrative Assistant

- 2024 Continuing Legal Education & Entrepreneur Event Series - February 23, 2024

- Government and Private Programs that Give to Founders - December 26, 2023

- Press Release: Atlanta Wins USPTO Southeast Regional Office: A Leap in Innovation and Growth - December 14, 2023