Government and Private Programs that Give to Founders

Empowering Innovation:

A Guide to Supportive Programs for Entrepreneurs

Access to the right resources can significantly impact entrepreneurial success. This curated guide is designed to inform and assist Founders by highlighting a variety of government and private sector programs. These initiatives offer financial support, strategic advantages, and unique opportunities to foster growth, innovation, and diversity in the business community.

From venture capital initiatives promoting diversity to economic development efforts aimed at revitalizing communities, this guide explores a comprehensive array of strategies founders can leverage to propel their ventures forward.

Table of Contents:

- Gaingels: Championing Diversity in Venture Capital

- Women Who Tech Startup Grants Program

- Atlanta Startup Growth Loan Program (ASGL)

- CDFI Fund: Fueling Economic Growth in Distressed Communities

- SDVOSB: Service-Disabled Veteran-Owned Small Business Program

- Invest Atlanta: Driving Economic Prosperity

- First-Time Filer Expedited Examination

Gaingels: Championing Diversity in Venture Capital

Gaingels stands as a prominent investor group committed to fostering diversity, representation, and equity within the venture capital ecosystem. With a focus on delivering above-market returns, Gaingels actively invests in companies dedicated to building diverse and inclusive teams, particularly representing the LGBTQ community and other underrepresented groups.

Key Points of Gaingels’ Initiatives:

- Venture Inclusion Program: Gaingels’ Venture Inclusion Program (VIP) is a suite of initiatives aimed at increasing minority participation in the innovation economy. This includes career fairs, board diversity recruitment, and scholarships, all funded by Gaingels and its partners.

- Board Diversity: Gaingels assists its portfolio companies in recruiting diverse board members, working with a variety of organizations to find qualified candidates from underrepresented backgrounds.

- Gaingels Scholarship: Established in 2020, the Gaingels Scholarship program supports need-based LGBTQIA+ and minority students with $5,000 grants, helping them cover tuition costs and providing opportunities for internships and mentorship.

- Diversity Term Sheet Rider Initiative: As a founding party of this initiative, Gaingels encourages companies and investors to allocate a portion of funding rounds to diverse check writers, promoting financial inclusivity at the core of deal-making.

- Corporate Responsibility and Philanthropy: Gaingels is a signatory of the 1% Pledge, committing a portion of its future upside to philanthropic causes, particularly supporting the LGBTQIA+ community.

Learn more about Gaingels’ impactful work in venture capital. For legal advice on navigating investment opportunities with a focus on diversity and inclusion, our team at Founders Legal is always here to advise.

Women Who Tech Startup Grants Program

Women Who Tech is at the forefront of closing the funding gap for women-led tech startups globally. Through its Startup Grants Program, Women Who Tech provides equity-free grants to innovative women-led tech startups, supporting them in overcoming the challenges of the tech industry.

Key Points of Women Who Tech Startup Grants Program:

- Equity-Free Grants: Women Who Tech awards equity-free grants to women-led tech startups on a rolling basis through 2023, ensuring continual support for emerging businesses.

- Thematic Grant Cycles: The program opens calls for applicants based on different themes, allowing startups to apply for grants that align with their specific sector or innovation focus.

- Virtual Pitch Coaching and Series: Selected finalists receive virtual pitch coaching and participate in a pitch series, providing them with valuable exposure and feedback.

- Diverse Grant Categories: Past grants have included categories like Tech, FemTech + HealthTech, Emerging Tech, and COVID-19 Tech, each offering Innovation and Impact Grants of varying amounts.

- Global Reach and Impact: As one of the largest networks of women-led startups, investors, and allies, Women Who Tech fosters diversity and funding in the tech sector on a global scale.

Learn more about the Women Who Tech Startup Grants Program. For guidance on applying and leveraging these opportunities for your startup, contact our team at Founders Legal.

Atlanta Startup Growth Loan Program (ASGL)

Mayor Andre Dickens has announced the Atlanta Startup Growth Loan Program (ASGL), a new initiative designed to bolster the growth of local technology startups in Atlanta. This program reflects the city’s commitment to nurturing the tech ecosystem and supporting innovative businesses in a dynamic market.

Key Features of the ASGL Program:

- Financial Support: The ASGL offers direct loans of up to $150,000 to help technology startups grow, scale, and upgrade or acquire new assets.

- Eligibility Criteria: To qualify, startups must be incorporated within the last five years, hold a City of Atlanta business license, and offer a scalable, high-impact technological solution.

- Diverse Sector Participation: The program is open to startups in various sectors, including AI, SaaS, Ecommerce, Manufacturing Sustainability, FinTech, and more.

- Flexible Operation Locations: Eligible startups can operate from various locations within Atlanta, including home offices, commercial spaces, incubators, accelerators, or co-working spaces.

- Growth Potential: Applicants must demonstrate significant growth potential in their respective sectors to qualify for the loan.

For more information on the ASGL program and application details, visit the Invest Atlanta website. Founders Legal offers business-informed legal advice to startups looking to leverage this opportunity for growth and expansion. Schedule a consultation to get started.

CDFI Fund – Fueling Economic Growth in Distressed Communities

The Community Development Financial Institutions (CDFI) Fund plays a pivotal role in stimulating economic growth and opportunity in some of the most economically distressed communities across the United States. By strategically combining federal funds with private sector capital, the CDFI Fund supports mission-driven financial institutions that adopt a market-based approach to aid economically disadvantaged areas.

Key Aspects of the CDFI Fund:

- Tailored Financial Resources: The CDFI Fund offers a range of financial products tailored to meet the unique needs of distressed communities, facilitating economic revitalization and community development.

- Innovative Programs: Through innovative programs, the CDFI Fund injects new sources of capital into neighborhoods that traditionally lack access to financing, thereby fostering economic inclusion and growth.

- CDFI Certification: Financial institutions with a mission to serve economically disadvantaged communities are encouraged to obtain CDFI Certification. This certification enables them to participate in various CDFI Fund programs and access additional resources.

- Community Impact: The CDFI Fund’s initiatives are designed to have a significant impact on local economies, supporting small businesses, affordable housing, and community facilities in underserved areas.

Learn more about the CDFI Fund and how it can benefit communities. If you require legal assistance or guidance in participating in CDFI Fund programs, our team at Founders Legal is ready to help.

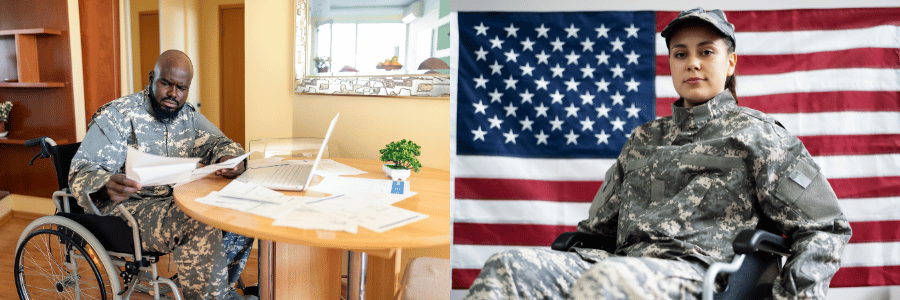

SDVOSB: Service-Disabled Veteran-Owned Small Business Program

The Service-Disabled Veteran-Owned Small Business (SDVOSB) Program is a federal initiative designed to empower businesses owned by service-disabled veterans. This program plays a crucial role in ensuring that a significant portion of federal contracting dollars is allocated to these businesses, fostering growth and recognition for their contributions.

Key Features of the SDVOSB Program:

- Federal Contracting Opportunities: The federal government targets to award at least 3% of all federal contracting dollars annually to SDVOSBs, providing substantial business opportunities.

- Exclusive Competition: Certain federal contract opportunities are exclusively set aside for businesses participating in the SDVOSB program, reducing competition and increasing chances of success.

- Self-Certification Process: Through 2023, SDVOSBs can self-certify their status to compete for set-aside contracts at most federal agencies. This process involves updating the socio-economic status section of the business profile on SAM.gov.

- SBA Certification Requirement: Starting January 1, 2024, the Department of Veterans Affairs (VA) will require SDVOSBs to obtain certification from the Small Business Administration (SBA) to be eligible for set-aside contracts.

- Support for Veteran Entrepreneurs: This program underscores the federal government’s commitment to supporting service-disabled veterans in the business sector, acknowledging their service and entrepreneurial spirit.

For more information on the SDVOSB program and assistance in the certification process, visit SAM.gov. Founders Legal provides business-focused legal guidance to service-disabled veteran entrepreneurs looking to navigate and benefit from this program. Contact us!

Invest Atlanta: Driving Economic Prosperity

Invest Atlanta is the City of Atlanta’s official economic development authority. This organization plays a key role in facilitating business growth and fostering comprehensive development strategies that enhance the city’s competitiveness. Invest Atlanta focuses on building a strong and equitable city by supporting business growth, housing affordability, and innovation.

Key Programs Offered by Invest Atlanta:

- Startups & Creative Programs: Business Assistance, DealRoom Startup-Investor Platform, iVillage at MLK, New and Emerging Technology Business Tax Waiver, Opportunity Zone State Tax Credits, Women’s Entrepreneurship Initiative.

- Small Business Programs: Business Assistance, Atlanta Open for Business Fund, Atlanta Recovery Loan Program, Atlanta Startup Growth Program, Commercial Down Payment Assistance, Commercial Property Improvement Grant, Opportunity Zone State Tax Credits, Small Business Loan Programs, Small Business Improvement Grants, Small Business Resource Centers, NPU-V Small Commercial Property Improvement Grant.

- Medium / Large Business Programs: Business Assistance, Site Selection Assistance, Opportunity Zone State Tax Credits.

Invest Atlanta’s diverse range of programs is designed to support businesses of all sizes. These initiatives aim to stimulate economic growth, encourage innovation, and promote sustainable development across Atlanta. Learn more at InvestAtlanta.com

For more information on how these programs can benefit your business and for legal guidance related to these opportunities, consult with our experienced team at Founders Legal.

First-Time Filer Expedited Examination for Patents

The U.S. Patent and Trademark Office (USPTO) introduced the First-Time Filer Expedited Examination Pilot Program (FTEEP) to streamline the patent application process for first-time inventors in the U.S. Non-Provisional Utility Patent Space.

FTEEP Key Points:

- Expedited Examination: The FTEEP accelerates the issuance of the first Office action, allowing inventors to make informed decisions more quickly.

- Fee Structure: The program does not require an additional petition fee. Standard fees for filing a patent application still apply.

- Timeframe and Limitations: The USPTO will accept petitions until March 11, 2024, or until 1,000 patent applications have been granted special status.

- Eligibility: The program is open to inventors who have never been named as an inventor on a U.S. non-provisional utility application. This aims to diversify the pool of patent applicants and encourage innovation from a broader range of individuals.

Learn more about the FTEEP. For professional guidance through every stage of the patent application process, schedule a consultation with our experienced patent attorneys.

- 2024 Continuing Legal Education & Entrepreneur Event Series - February 23, 2024

- Government and Private Programs that Give to Founders - December 26, 2023

- Press Release: Atlanta Wins USPTO Southeast Regional Office: A Leap in Innovation and Growth - December 14, 2023